홈

Communication

Newsroom

Inside SKC

SKC Announces 2026 Organizational Restructuring and Annual Executive Appointments

l Streamlined

organizational structure to strengthen execution; new leaders appointed with proven

on-site operational and R&D expertisel SKC: “Restructuring to respond more agilely

to market conditions and reinforce fundamental competitiveness through

organizational transformation”

SKC announced its

2026 annual executive appointments aimed at reinforcing fundamental

competitiveness in its core businesses amid rapidly changing market conditions.

The appointments focus

on a strategic realignment of leadership to streamline the organizational

structure and strengthen execution. SKC also appointed new leaders with

extensive on-site experience and strong R&D capabilities.

As part of the

annual appointments, SKC appointed Park Dong-ju as Chief Financial Officer

(CFO) to accelerate efforts to enhance financial soundness and optimize the

business structure. Park, a finance specialist who led key financial strategies

at SK Inc., will focus on strengthening SKC’s business fundamentals.

The company has

strengthened leadership to drive momentum in the glass substrate business. SKC

appointed Kang Ji-ho as the new CEO of Absolics. Kang brings 15 years of

semiconductor technology and operations experience from Intel and, most

recently, led C&C (Cleaning & CMP) process technology at SK hynix. He

is expected to further enhance the competitiveness of the business.

Leadership integration

has also been reinforced to accelerate performance across core businesses. Kim

Jong-woo, President and CEO of SKC, will concurrently serve as CEO of SK Nexilis,

spearheading competitiveness in the battery materials segment. Park Dong-ju,

the newly appointed CFO of SKC, will also concurrently serve as CFO of SK Nexilis

to improve the efficiency of financial operations.

An SKC official

said, “With this organizational restructuring and executive appointments, we

have established a structure that enables us to respond more agilely to

evolving market conditions.” The official added, “We will continue our efforts

to strengthen our organizational foundation for sustainable growth.” [End]

[SKC Executive Appointments for 2026]

△ CEOs of

Subsidiaries

▲ Kim Jong-woo,

CEO, SK Nexilis (Concurrently President & CEO, SKC)

▲ Kang

Ji-ho, CEO, Absolics

▲ Chang

Ji-hyup, CEO, SK picglobal

△ New Appointment

▲ Park

Dong-ju, Chief Financial Officer (CFO), SKC

2025-12-08

SKC Announces 2026 Organizational Restructuring and Annual Executive Appointments

l Streamlined

organizational structure to strengthen execution; new leaders appointed with proven

on-site operational and R&D expertisel SKC: “Restructuring to respond more agilely

to market conditions and reinforce fundamental competitiveness through

organizational transformation”

SKC announced its

2026 annual executive appointments aimed at reinforcing fundamental

competitiveness in its core businesses amid rapidly changing market conditions.

The appointments focus

on a strategic realignment of leadership to streamline the organizational

structure and strengthen execution. SKC also appointed new leaders with

extensive on-site experience and strong R&D capabilities.

As part of the

annual appointments, SKC appointed Park Dong-ju as Chief Financial Officer

(CFO) to accelerate efforts to enhance financial soundness and optimize the

business structure. Park, a finance specialist who led key financial strategies

at SK Inc., will focus on strengthening SKC’s business fundamentals.

The company has

strengthened leadership to drive momentum in the glass substrate business. SKC

appointed Kang Ji-ho as the new CEO of Absolics. Kang brings 15 years of

semiconductor technology and operations experience from Intel and, most

recently, led C&C (Cleaning & CMP) process technology at SK hynix. He

is expected to further enhance the competitiveness of the business.

Leadership integration

has also been reinforced to accelerate performance across core businesses. Kim

Jong-woo, President and CEO of SKC, will concurrently serve as CEO of SK Nexilis,

spearheading competitiveness in the battery materials segment. Park Dong-ju,

the newly appointed CFO of SKC, will also concurrently serve as CFO of SK Nexilis

to improve the efficiency of financial operations.

An SKC official

said, “With this organizational restructuring and executive appointments, we

have established a structure that enables us to respond more agilely to

evolving market conditions.” The official added, “We will continue our efforts

to strengthen our organizational foundation for sustainable growth.” [End]

[SKC Executive Appointments for 2026]

△ CEOs of

Subsidiaries

▲ Kim Jong-woo,

CEO, SK Nexilis (Concurrently President & CEO, SKC)

▲ Kang

Ji-ho, CEO, Absolics

▲ Chang

Ji-hyup, CEO, SK picglobal

△ New Appointment

▲ Park

Dong-ju, Chief Financial Officer (CFO), SKC

2025-12-01

SKC Announces Q3 Earnings: “Sustained Recovery, Visible Progress in New Businesses”

●EV battery materials: North America sales expand; Malaysia plant sales increase, boosting profitability●Test socket/equipment merger synergies materialize; glass substrate samples enter customer qualification process●Bolsters financial health via increased cash inflows; aims for an efficient capital structure centered on core businessesSKC announced on November 5 that it recorded consolidated revenue of KRW 506 billion and an operating loss of KRW 52.8 billion for the third quarter of 2025. Compared to the previous quarter, sales rose by 9 percent, while the operating loss improved by KRW 17.5 billion. The Company surpassed the 500-billion-KRW quarterly sales mark for the first time in two years, continuing a clear trend of sales growth and improved profitability.By business segment, the EV battery materials division posted sales of KRW 166.7 billion and an operating loss of KRW 35.0 billion. Sales to North America expanded significantly, resulting in a 31 percent quarter-over-quarter increase in revenue. In particular, sales of copper foil for LFP-based energy storage systems (ESS) applications grew sharply, driving overall sales growth. The Malaysian plant also steadily increased sales volume, contributing to improved profitability.The semiconductor materials business recorded KRW 64.5 billion in sales and operating profit of KRW 17.4 billion. Synergies from the merger of the test socket and equipment businesses began to materialize in earnest, driving the division to its highest-ever quarterly revenue. In particular, the test socket business achieved a quarterly operating margin of 33 percent, supported by strong sales of high value-added products for AI-driven non-memory applications.SKC's glass substrate business, which the Company aims to commercialize as a world first, has commenced the customer qualification process following the production of its first mass-production prototype samples at the Georgia plant. The prototypes achieved positive results in simulation tests, putting commercialization on track for next year.The chemical business posted sales of KRW 273.5 billion and an operating loss of KRW 7.4 billion. Backed by stable demand, the division maintained steady sales, while the operating loss narrowed significantly from the previous quarter due to stabilization in raw material costs. In the fourth quarter, demand for PG is expected to rise due to seasonal factors, and the Company plans to continue its cost-optimization efforts.Financial performance also showed notable progress. The Company significantly increased cash inflows through the issuance of perpetual bonds exchangeable into shares (EBs) and the sale of non-core semiconductor businesses, thereby accelerating efforts to strengthen its financial health. SKC plans to complete its rebalancing initiatives by year-end and establish an efficient capital structure centered on its core businesses.An SKC official said, “We are focusing on strengthening the competitiveness of each business and establishing a profitability-centered growth model”, adding, “Alongside continued efforts to generate results from new businesses such as glass substrates, we will also focus our efforts on strengthening medium- to long-term financial stability.” [End]

2025-11-05

SKC Earns International ISO 37301 Certification for Compliance Management

●SKC held a certification ceremony on June 4 at its Chungmuro headquarters, officially recognizing its internal control system as meeting global standards●Following its ISO 37001 certification, SKC has now earned ISO 37301—marking a major step forward in its ethical and compliance management framework● Plans are underway to enhance compliance management through dedicated teams and newly formed consultative bodiesSKC (CEO Woncheol Park) announced on June 4 that it has obtained ISO 37301, the international standard for compliance management systems, from the Korea Management Registrar (KMR).A certification ceremony was held the same day at SKC’s headquarters in Chungmuro, Seoul, attended by Kim Yoon-hoe, Head of Compliance at SKC, and Hwang Eun-ju, CEO of KMR, the ISO certification body. ISO 37301 is an international certification granted to organizations with globally recognized compliance systems, based on an evaluation of their internal controls, ethics, and compliance culture.SKC previously received ISO 37001 certification, the international standard for anti-bribery management systems, in 2023. The newly acquired ISO 37301 certification reflects the company’s continued efforts to advance its ethical and compliance system.In line with SK Group’s vision of achieving globally competitive management standards, SKC has designated key organizations as compliance priorities and identified the relevant laws and regulations applicable to each unit. The company has also revised major policies and operational manuals to strengthen its compliance control environment.Looking ahead, SKC plans to enhance its compliance management system through the establishment of dedicated teams and new consultative bodies. The company also plans to expand training programs on key areas such as fair trade to enhance employee awareness.An SKC representative stated, “This compliance management certification provides a solid foundation for strengthening our compliance practices in the long term,” adding, “We will continue to uphold fair and transparent management practices as we strive to become a more trusted company.”

2025-06-04

SKC Announces Q1 2025 Results: Clear Sign of Recovery in Battery Materials Business

● Recorded KRW 438.5 billion in revenue and KRW 74.5 billion in operating loss in Q1 2025●Battery copper foil sales rebounding on increased demand; global customer contracts underway●Semiconductor test socket sales growth to accelerate in Q2; U.S. subsidy for Absolics anticipatedSKC (CEO Woncheol Park) announced its consolidated financial results for the first quarter of 2025 on April 30, reporting revenue of KRW 438.5 billion and an operating loss of KRW 74.5 billion. Despite continued weakness in downstream industries, revenue rose by approximately 3% and the operating loss narrowed by about 10% compared to the previous quarter.By business segment, the battery materials division showed clear sign of recovery. Copper foil sales rebounded on growing demand for electric vehicle (EV) batteries, with Q1 sales volume increasing by 14% quarter-over-quarter and 8% year-over-year. Notably, sales in the North American market surged 69% from the previous quarter and 149% from the same period last year, significantly contributing to the segment's performance. In addition, the operating loss narrowed by 18% quarter-over-quarter, driven by a sharp rise in the utilization at the Malaysia plant.In the semiconductor materials segment, sales of test sockets for non-memory applications temporarily declined due to adjustments in customers’ R&D and mass production schedules. Nevertheless, the segment maintained a solid operating margin of over 20%, demonstrating stable performance. The chemicals business achieved revenue growth from the previous quarter, despite continued weakness in styrene monomer (SM) spreads. Sales of its key product, propylene glycol (PG) remained stable, particularly in high-value markets such as North America and Europe.SKC plans to focus on improving profitability in the battery materials business, driving stable revenue growth in its semiconductor test sockets, and commercializing its glass substrates business in 2025.The battery materials business is expected to continue its upward momentum into Q2, driven by increasing utilization rates at customer battery plants in North America. In particular, SKC plans to finalize multiple supply agreements with global battery manufacturers during the quarter, which—together with the full-scale ramp-up of its Malaysia plant—will further enhance profitability.In the semiconductor segment, sales growth is expected to accelerate in Q2, led by increased demand from North American customers and the resumption of R&D orders from major global tech companies. In addition, U.S. government subsidies for Absolics’ manufacturing operations under the CHIPS Act are expected to be disbursed during the quarter.An SKC representative said, “We are seeing a clear recovery in copper foil sales within the battery materials business. Meanwhile, our test socket business continues to show stable performance, and preparations for the commercialization of glass substrates are proceeding as planned. We will further accelerate our efforts to strengthen the fundamentals of existing businesses while making tangible progress in new growth areas to support a performance rebound.”

2025-04-30

SKC Holds Annual General Meeting of Shareholders "Strengthening Business Competitiveness to Meet Shareholder Expectations"

● The meeting was held on March at the company’s headquarters in Jongno-gu, Seoul, with enhanced accessibility via online live streaming and an IR briefing session● Continued efforts to secure financial soundness; glass substrate business on track for timely mass production after obtaining certification from multiple customers● New appointments include Kim Ki-dong as a non-executive director and Jeong Hyun-wook as an independent director. Chae Eun-mi appointed as SKC’s first female chairpersonSKC (CEO Woncheol Park) held its 52nd Annual General Meeting of Shareholders on March 26 at the company's headquarters in Jongno-gu, Seoul.SKC once again enhanced accessibility by live streaming its Annual General Meeting of Shareholders. Notably, this year’s meeting was followed by a shareholder briefing session that provided updates on key business initiatives.Park Won-cheol, CEO of SKC and chair of the meeting, stated, "We have completed the first phase of our portfolio rebalancing, centered on our three core businesses: EV batteries, semiconductors, and eco-friendly solutions." He also mentioned, "In line with this, we launched our new glass substrate business and acquired ISC, a global leader in semiconductor test solutions, to further strengthen our semiconductor portfolio."He continued, "To ensure financial soundness, we worked to bolster our fundamentals by divesting low-growth, non-core businesses, including the film and polyurethane sectors." He emphasized, "Going forward, we will focus on enhancing our business competitiveness to meet shareholder expectations."SKC also announced plans to generate tangible results in its highly anticipated glass substrate business by obtaining certifications from multiple customers within the year.CEO Park stated, "Georgia Plant 1, the world’s first mass production line for glass substrates, is currently in the commissioning phase with the goal of commencing mass production on schedule." He added, "We have secured multiple top-tier global customers in the field of high-performance computing, AI servers, and high-frequency wireless communications, and are also engaged in discussions with various partners across the value chain." Regarding the copper foil business, he projected, "Based on the mid- to long-term sales contracts signed with multiple customers last year, we expect a stable recovery in sales volume this year."At the board meeting held immediately after the Annual General Meeting of Shareholders, the motion to appoint Chae Eun-mi, an independent director, as SKC's first female chair of the board was approved. Appointed as an independent director in 2023, Chair Chae previously served as the first Korean Manager of FedEx Korea, a global express delivery company. Leveraging her expertise in labor relations and global management, she has contributed to strengthening the board's effectiveness by providing strategic guidance and oversight on major decisions at SKC.Additionally, Woncheol Park, CEO of SKC, was reappointed as an executive director, while Kim Ki-dong, CFO of SK Inc., was newly appointed as a non-executive director. Furthermore, Jeong Hyun-wook, a certified public accountant at Kim & Chang Law Firm, was appointed as an independent director. Other agenda items, including the approval of financial statements and the limit of directors’ remuneration, were also approved as originally proposed. [End]

2025-03-26

SKC Announces 2024 Earnings… "Full Efforts to Restore Fundamentals"

lAnnounced 2024 results on February 11, reporting a 15% YoY revenue increase despite challenging market conditionslStrengthening core business competitiveness while accelerating the foundation for new business growthlPrioritizing long-term sustainability through the accelerated implementation of Operation Improvement (O/I)SKC (CEO Woncheol Park) reported on February 11 that the company’s consolidated revenue reached 1.72 trillion KRW for 2024, with an operating loss of 276.8 billion KRW.Despite challenging conditions in downstream industries, revenue grew by approximately 15% year-over-year, though operating losses widened. SKC has continued to strengthen the foundation for a performance rebound, focusing on its three key growth pillars: EV batteries, semiconductors, and eco-friendly materials.SK Nexilis, an investee specialized in copper foil production for EV batteries, has concentrated on increasing the utilization rate of its cost-competitive Malaysian plant and securing new supply contracts in Greater China. Additionally, the company achieved financial milestones, including improving its debt structure and securing subsidies from the Polish government.SKC successfully restructured its semiconductor business, shifting to high-value-added materials and components. ISC, the test socket investee acquired in 2023, drove overall performance with a 25% increase in revenue and a 320% surge in operating profit year-over-year. The glass substrate business, recognized as a next-generation technology, is progressing smoothly based on the world’s first mass production facility in Georgia, USA. Additionally, the company secured U.S. government semiconductor subsidies, further validating its industry-leading technological capabilities.The commercialization of the eco-friendly materials business is progressing as planned. The biopolymer (PBAT) production facility in Vietnam, with an annual capacity of 70,000 tons, is set for completion in the second half of this year, while the company accelerates efforts to establish its sales infrastructure.SKC is fully committed to enhancing its core competitiveness by boosting revenue in its key businesses and solidifying the foundation for new ventures. Additionally, the company aims to enhance financial stability through company-wide cost reduction initiatives and Operation Improvement (O/I) activities, which have been in place since last year.The copper foil business aims to achieve more than double the sales volume compared to the previous year, driven by the full-scale revenue generation from major customers in Greater China and the gradual increase in utilization rates of existing customers. With the rise in production capacity at the Malaysian plant, a recovery in quarterly profitability is also anticipated.Absolics, the investee for the glass substrate business, is on track to achieve concrete results by completing certifications with multiple global big-tech customers within the year. ISC is anticipated to continue its robust growth through the expansion of sales of AI test sockets to global clients.An official at SKC stated, "Despite a slower-than-expected market recovery last year, we will lay the groundwork for a recovery in performance by strengthening the fundamentals of existing businesses and through the commercialization of the glass substrate business, alongside achievements in other new ventures." [End]

2025-02-12

SKC Emphasized “Overcoming the Recession and Strengthening the Profit Structure” in the Annual General Meeting of Shareholders.

● SKC’s Annual General Meeting of Shareholders was held on March 26 at its headquarters in Jongno-gu, Seoul, with live online streaming for the second consecutive year to enhance shareholder accessibility.●New appointments include inside director Jihan Yu and non-executive director Changho Shin, and outside director Siwon Park was reappointed.●CEO Woncheol Park: “To focus on strengthening the profit structure and stabilizing new businesses in the early phase.”SKC (CEO Woncheol Park) held its 51st Annual General Meeting of Shareholders (AGM) on the morning of March 26 on Floor 6 of its headquarters at Jongno-gu, Seoul. Following last year, SKC live-streamed the AGM online once again to improve shareholder accessibility.As the chair of the AGM, SKC CEO Woncheol Park reported business performance results to shareholders, stating, “Last year, we experienced an unprecedented business environment in which front markets for our major businesses, such as EV batteries, semiconductors, and chemicals, subsided simultaneously.” He further explained, “Despite uncertainty in the business environment, we upgraded our business portfolios by achieving flexibility for front-end processes in non-core businesses of chemicals and semiconductors and investing in high value-added semiconductor back-end processing.”SKC has also consistently reinforced its ESG management. In July last year, it received an ‘A’ rating from Morgan Stanley Capital International (MSCI), one grade higher than the previous year. Its rating assessed by the Korea Institute of Corporate Governance and Sustainability (KCGS) was also upgraded to ‘A+’ in October of the same year.“We will strengthen the profit structure of our main businesses, such as copper foil for EV batteries and semiconductor test sockets, and promote early stabilization of new businesses, including semiconductor glass substrates and biodegradable materials,” explained CEO Woncheol Park regarding this year’s business strategies and emphasized, “We will strive for enhanced mid- to long-term sustainability through exhaustive risk management.” After the business report, explanations were provided for questions submitted by shareholders online in advance.At the AGM, Jihan Yu, SKC’s Chief Financial Officer (CFO) and Head of the Business Supporting Division, was newly appointed as an inside director, and Changho Shin, SK Inc.’s Head of the Portfolio Management Division, as a non-executive director. In addition, Siwon Park, a professor at Kangwon National University School of Law, was reappointed as an outside director.With these appointments, SKC aims to enhance the Board’s expertise in finance and investment while further strengthening its supervision functions over the management. The reappointment of director Siwon Park also allowed the ratio of female directors among outside directors to remain at 50%. Other bills to approve the financial statements and directors’ remuneration ceilings were passed.An SKC executive said, “Although the business environment remains uncertain this year, we will overcome it and secure the company’s profitability,” and added, “We promise to make our utmost effort to ensure that the company’s growth leads to increased shareholder value.” [End]

2024-03-26

SKC Emphasized “Overcoming the Recession and Strengthening the Profit Structure” in the Annual General Meeting of Shareholders.

● SKC’s Annual General Meeting of Shareholders was held on March 26 at its headquarters in Jongno-gu, Seoul, with live online streaming for the second consecutive year to enhance shareholder accessibility.●New appointments include inside director Jihan Yu and non-executive director Changho Shin, and outside director Siwon Park was reappointed.●CEO Woncheol Park: “To focus on strengthening the profit structure and stabilizing new businesses in the early phase.”SKC (CEO Woncheol Park) held its 51st Annual General Meeting of Shareholders (AGM) on the morning of March 26 on Floor 6 of its headquarters at Jongno-gu, Seoul. Following last year, SKC live-streamed the AGM online once again to improve shareholder accessibility.As the chair of the AGM, SKC CEO Woncheol Park reported business performance results to shareholders, stating, “Last year, we experienced an unprecedented business environment in which front markets for our major businesses, such as EV batteries, semiconductors, and chemicals, subsided simultaneously.” He further explained, “Despite uncertainty in the business environment, we upgraded our business portfolios by achieving flexibility for front-end processes in non-core businesses of chemicals and semiconductors and investing in high value-added semiconductor back-end processing.”SKC has also consistently reinforced its ESG management. In July last year, it received an ‘A’ rating from Morgan Stanley Capital International (MSCI), one grade higher than the previous year. Its rating assessed by the Korea Institute of Corporate Governance and Sustainability (KCGS) was also upgraded to ‘A+’ in October of the same year.“We will strengthen the profit structure of our main businesses, such as copper foil for EV batteries and semiconductor test sockets, and promote early stabilization of new businesses, including semiconductor glass substrates and biodegradable materials,” explained CEO Woncheol Park regarding this year’s business strategies and emphasized, “We will strive for enhanced mid- to long-term sustainability through exhaustive risk management.” After the business report, explanations were provided for questions submitted by shareholders online in advance.At the AGM, Jihan Yu, SKC’s Chief Financial Officer (CFO) and Head of the Business Supporting Division, was newly appointed as an inside director, and Changho Shin, SK Inc.’s Head of the Portfolio Management Division, as a non-executive director. In addition, Siwon Park, a professor at Kangwon National University School of Law, was reappointed as an outside director.With these appointments, SKC aims to enhance the Board’s expertise in finance and investment while further strengthening its supervision functions over the management. The reappointment of director Siwon Park also allowed the ratio of female directors among outside directors to remain at 50%. Other bills to approve the financial statements and directors’ remuneration ceilings were passed.An SKC executive said, “Although the business environment remains uncertain this year, we will overcome it and secure the company’s profitability,” and added, “We promise to make our utmost effort to ensure that the company’s growth leads to increased shareholder value.” [End]

2024-03-26

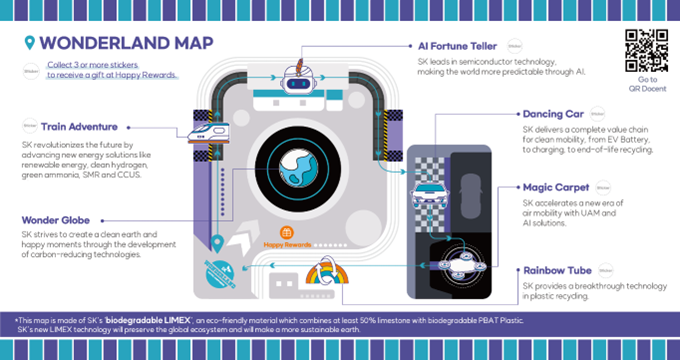

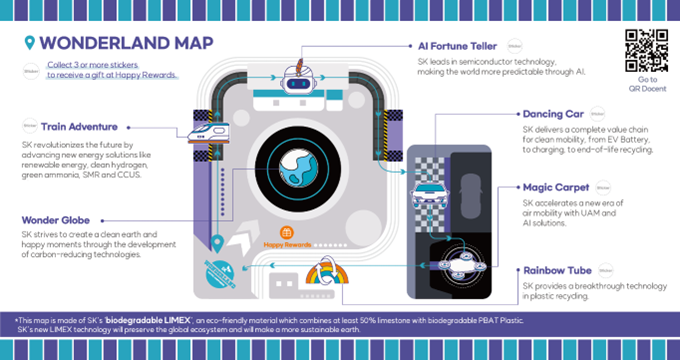

SKC Showcases Eco-friendly Materials Technology at the Theme Park Exhibition Space ‘SK Wonderland.’

● SKC introduces its flagship products of EV batteries, semiconductors, and eco-friendly materials in the exhibition space jointly operated by SK Group’s seven affiliates.●Participating in CES for five consecutive years since 2019, SKC continues introducing its innovative business model direction to the global market.SKC (CEO & President Woncheol Park) will showcase its materials technologies covering EV batteries, semiconductors, and eco-friendly sectors at CES (Consumer Electronics Show) 2024, the world’s largest industrial exhibition, held in Las Vegas, USA from January 9 to 12 next month (local time).At CES 2024, SKC will introduce its flagship products and technologies throughout SK Wonderland, an exhibition space jointly operated by SK Group’s seven affiliates. SK Wonderland is designed in a theme park format, allowing visitors to experience happiness in the ‘Net Zero’ world, where the climate crisis has been resolved.SKC’s products and technologies can be explored when visitors enter the exhibition. The guide map distributed when entering SK Wonderland is not made from regular paper. It is made of SKC’s biodegradable LIMEX, an eco-friendly new material combining the biodegradable plastic material PBAT with limestone-based LIMEX, which is harmless to nature. SKC has been working to commercialize biodegradable LIMEX materials since establishing a joint venture called SK TBMGEOSTONE in 2021, jointly with TBM, a Japanese company that owns LIMEX technology.In the Dancing Car zone, SK Group’s eco-friendly EV technologies are introduced as automobiles hanging from robot arms move like dancers in front of the screen. This is where copper foil, a key material for EV batteries, and silicon anodes that can significantly reduce EV charging time are presented. SKC has initiated the global expansion of its copper foil business with the first shipment from SK Nexilis’ new production facility in Kota Kinabalu, Malaysia, in October this year. It will further commence pilot production of high-quality silicon anodes early next year.In addition, visitors can obtain information on semiconductor glass substrates for high-performance computing in the AI Fortune Teller zone. Glass substrates, which improve the performance of semiconductor packages, are again featured at CES 2024 as a solution to speed up AI servers processing large-scale data.SKC has participated in CES for five consecutive years since 2019 (CES 2021 was not held), introducing new technologies and its direction of business model innovations to the global market. While the company focused on its film business in 2019, the first year of participation, the exhibition content has evolved in line with the direction of business model innovations, such as copper foil, glass substrates, and biodegradable materials.An SKC executive said, “We plan to showcase ESG materials solutions in EV materials, semiconductors, and eco-friendly sectors through SK Wonderland, which will become a landmark of CES 2024,” and added, “SKC will continue to develop technologies to enhance added values and discover new businesses.” [End][CES 2024 SK Wonderland Guide Map made with SKC’s biodegradable LIMEX]

2023-12-27

SKC Showcases Eco-friendly Materials Technology at the Theme Park Exhibition Space ‘SK Wonderland.’

● SKC introduces its flagship products of EV batteries, semiconductors, and eco-friendly materials in the exhibition space jointly operated by SK Group’s seven affiliates.●Participating in CES for five consecutive years since 2019, SKC continues introducing its innovative business model direction to the global market.SKC (CEO & President Woncheol Park) will showcase its materials technologies covering EV batteries, semiconductors, and eco-friendly sectors at CES (Consumer Electronics Show) 2024, the world’s largest industrial exhibition, held in Las Vegas, USA from January 9 to 12 next month (local time).At CES 2024, SKC will introduce its flagship products and technologies throughout SK Wonderland, an exhibition space jointly operated by SK Group’s seven affiliates. SK Wonderland is designed in a theme park format, allowing visitors to experience happiness in the ‘Net Zero’ world, where the climate crisis has been resolved.SKC’s products and technologies can be explored when visitors enter the exhibition. The guide map distributed when entering SK Wonderland is not made from regular paper. It is made of SKC’s biodegradable LIMEX, an eco-friendly new material combining the biodegradable plastic material PBAT with limestone-based LIMEX, which is harmless to nature. SKC has been working to commercialize biodegradable LIMEX materials since establishing a joint venture called SK TBMGEOSTONE in 2021, jointly with TBM, a Japanese company that owns LIMEX technology.In the Dancing Car zone, SK Group’s eco-friendly EV technologies are introduced as automobiles hanging from robot arms move like dancers in front of the screen. This is where copper foil, a key material for EV batteries, and silicon anodes that can significantly reduce EV charging time are presented. SKC has initiated the global expansion of its copper foil business with the first shipment from SK Nexilis’ new production facility in Kota Kinabalu, Malaysia, in October this year. It will further commence pilot production of high-quality silicon anodes early next year.In addition, visitors can obtain information on semiconductor glass substrates for high-performance computing in the AI Fortune Teller zone. Glass substrates, which improve the performance of semiconductor packages, are again featured at CES 2024 as a solution to speed up AI servers processing large-scale data.SKC has participated in CES for five consecutive years since 2019 (CES 2021 was not held), introducing new technologies and its direction of business model innovations to the global market. While the company focused on its film business in 2019, the first year of participation, the exhibition content has evolved in line with the direction of business model innovations, such as copper foil, glass substrates, and biodegradable materials.An SKC executive said, “We plan to showcase ESG materials solutions in EV materials, semiconductors, and eco-friendly sectors through SK Wonderland, which will become a landmark of CES 2024,” and added, “SKC will continue to develop technologies to enhance added values and discover new businesses.” [End][CES 2024 SK Wonderland Guide Map made with SKC’s biodegradable LIMEX]

2023-12-27

SKC unveils future technology blueprints for EV batteries, semiconductors, and eco-friendly materials

● SKC Tech Day 2023 was held on November 9 at SKC headquarters in Jongno-gu, Seoul.… Sharing technological roadmaps for core and new businesses● Showcasing super gap technologies, including future EV battery anode current collectors, rubber sockets for semiconductor testing, and biodegradable nonwovens● Highlighting competitive patent assets for each business… 230 copper foil patents, the largest patent network in the industry.SKC (CEO & President Woncheol Park) held SKC Tech Day 2023 on November 9 at its headquarters in Jongno-gu, Seoul, and unveiled technology blueprints for core and new businesses. SKC Tech Day is an event where SKC shares its research and development status and technology roadmaps with the market.SKC introduced various new technologies at SKC Tech Day 2023, including silicon anode materials, semiconductor glass substrates, and eco-friendly biodegradable materials together with copper foil for EV batteries, which has become SKC’s core business. Additionally, SKC’s recently acquired ISC debuted its semiconductor test solution technology at Tech Day.Regarding the EV battery materials business, where SKC has the top global competitiveness in technology, the company shared the achievements in developing copper foil for the 4680 cylindrical battery and R&D directions for anode collectors to be used in future EV batteries, such as all-solid-state batteries. Jung-kyu Ahn, Chief of SK nexilis Materials Technology Development Center, explained, “We are developing customer solutions having properties required by future EV battery anode current collectors, such as high strength, high elongation, high heat resistance, and corrosion inhibition.”The current status of patent assets related to copper foil was also shared at Tech Day. As of March of this year, SK nexilis had the most extensive patent network in the industry, with 230 applications. Cooper foil requires advanced manufacturing technology in that it significantly influences the productivity of EV battery manufacturers, not to mention the performance of EV batteries. SK nexilis produces top-quality copper foil based on technology accumulated through continuous research and development.Next came the introduction of silicon anode materials' technological competitiveness, which is considered a critical future element to feed on in the EV battery materials field along with copper foil. This year, SKC established a subsidiary, Ultimus, and plans to start pilot production in January next year by utilizing technology of UK-based tech company Nexeon, of which SKC became the largest shareholder through equity investment in January last year.In the semiconductor materials/components sector, glass substrates for high-performance computing and ISC’s semiconductor test solution technology were showcased. Absolics Inc., an invested subsidiary of SKC in the copper foil business, will complete the world’s first mass production facility at the end of this year. SKC also shared the company’s preparation for smart factory-based mass production, patent application status, and where the company is headed for next-generation product development, including AI Learning Accelerator with the expanded application of element embedding technology.ISC, which newly became a subsidiary of SKC this year, highlighted its excellent competitiveness in the market for rubber sockets, a key component for semiconductor testing. ISC succeeded in mass-producing rubber sockets for the first time in the world in 2003. It is considered to have secured a technological gap of more than ten years compared to latecomer competitors. Like SK nexilis, ISC has built the largest patent network in the industry, with 578 patents related to test sockets. ISC’s clients include over 300 global companies, including memory/non-memory semiconductor makers, fabless semiconductor companies, and big techs with large-scale servers.SKC also shared information on the eco-friendly biodegradable materials business, the company’s third growth engine, along with EV battery materials and semiconductor materials/components, introducing technological competence and commercialization efforts in progress for high-strength PBAT and biodegradable LIMEX materials. It was particularly underlined that 100% PBAT non-woven fabric, the first of its kind in the world developed by SKC, can potentially expand the market into hygiene products, wet wipes, and more, for which biodegradable materials have not previously been used.An SKC executive stated, “Based on the original technology secured through decades of continuous research and development, we are growing into a company with a technological moat that no other player can easily overcome,” and added, “We will actively also continue to communicate SKC’s technology roadmaps for the future market.” [End]

2023-11-09

A leading company that strive for the world’s best.

A leading company that strive for the world’s best.

Global ESG material solutions company

Global ESG material solutions company

SKC is making efforts to create a better future for all of our partners.

SKC is making efforts to create a better future for all of our partners.

SKC is making efforts to create a better future for all of our partners.

SKC is making efforts to create a better future for all of our partners.