SKC Holds Annual General Meeting of Shareholders "Strengthening Business Competitiveness to Meet Shareholder Expectations"

● The meeting was held on March at the company’s headquarters in Jongno-gu, Seoul, with enhanced accessibility via online live streaming and an IR briefing session● Continued efforts to secure financial soundness; glass substrate business on track for timely mass production after obtaining certification from multiple customers● New appointments include Kim Ki-dong as a non-executive director and Jeong Hyun-wook as an independent director. Chae Eun-mi appointed as SKC’s first female chairpersonSKC (CEO Woncheol Park) held its 52nd Annual General Meeting of Shareholders on March 26 at the company's headquarters in Jongno-gu, Seoul.SKC once again enhanced accessibility by live streaming its Annual General Meeting of Shareholders. Notably, this year’s meeting was followed by a shareholder briefing session that provided updates on key business initiatives.Park Won-cheol, CEO of SKC and chair of the meeting, stated, "We have completed the first phase of our portfolio rebalancing, centered on our three core businesses: EV batteries, semiconductors, and eco-friendly solutions." He also mentioned, "In line with this, we launched our new glass substrate business and acquired ISC, a global leader in semiconductor test solutions, to further strengthen our semiconductor portfolio."He continued, "To ensure financial soundness, we worked to bolster our fundamentals by divesting low-growth, non-core businesses, including the film and polyurethane sectors." He emphasized, "Going forward, we will focus on enhancing our business competitiveness to meet shareholder expectations."SKC also announced plans to generate tangible results in its highly anticipated glass substrate business by obtaining certifications from multiple customers within the year.CEO Park stated, "Georgia Plant 1, the world’s first mass production line for glass substrates, is currently in the commissioning phase with the goal of commencing mass production on schedule." He added, "We have secured multiple top-tier global customers in the field of high-performance computing, AI servers, and high-frequency wireless communications, and are also engaged in discussions with various partners across the value chain." Regarding the copper foil business, he projected, "Based on the mid- to long-term sales contracts signed with multiple customers last year, we expect a stable recovery in sales volume this year."At the board meeting held immediately after the Annual General Meeting of Shareholders, the motion to appoint Chae Eun-mi, an independent director, as SKC's first female chair of the board was approved. Appointed as an independent director in 2023, Chair Chae previously served as the first Korean Manager of FedEx Korea, a global express delivery company. Leveraging her expertise in labor relations and global management, she has contributed to strengthening the board's effectiveness by providing strategic guidance and oversight on major decisions at SKC.Additionally, Woncheol Park, CEO of SKC, was reappointed as an executive director, while Kim Ki-dong, CFO of SK Inc., was newly appointed as a non-executive director. Furthermore, Jeong Hyun-wook, a certified public accountant at Kim & Chang Law Firm, was appointed as an independent director. Other agenda items, including the approval of financial statements and the limit of directors’ remuneration, were also approved as originally proposed. [End]

2025-03-26

SKC Announces 2024 Earnings… "Full Efforts to Restore Fundamentals"

l Announced 2024 results on February 11, reporting a 15% YoY revenue increase despite challenging market conditionsl Strengthening core business competitiveness while accelerating the foundation for new business growthl Prioritizing long-term sustainability through the accelerated implementation of Operation Improvement (O/I) SKC (CEO Woncheol Park) reported on February 11 that the company’s consolidated revenue reached 1.72 trillion KRW for 2024, with an operating loss of 276.8 billion KRW.Despite challenging conditions in downstream industries, revenue grew by approximately 15% year-over-year, though operating losses widened. SKC has continued to strengthen the foundation for a performance rebound, focusing on its three key growth pillars: EV batteries, semiconductors, and eco-friendly materials.SK Nexilis, an investee specialized in copper foil production for EV batteries, has concentrated on increasing the utilization rate of its cost-competitive Malaysian plant and securing new supply contracts in Greater China. Additionally, the company achieved financial milestones, including improving its debt structure and securing subsidies from the Polish government.SKC successfully restructured its semiconductor business, shifting to high-value-added materials and components. ISC, the test socket investee acquired in 2023, drove overall performance with a 25% increase in revenue and a 320% surge in operating profit year-over-year. The glass substrate business, recognized as a next-generation technology, is progressing smoothly based on the world’s first mass production facility in Georgia, USA. Additionally, the company secured U.S. government semiconductor subsidies, further validating its industry-leading technological capabilities.The commercialization of the eco-friendly materials business is progressing as planned. The biopolymer (PBAT) production facility in Vietnam, with an annual capacity of 70,000 tons, is set for completion in the second half of this year, while the company accelerates efforts to establish its sales infrastructure.SKC is fully committed to enhancing its core competitiveness by boosting revenue in its key businesses and solidifying the foundation for new ventures. Additionally, the company aims to enhance financial stability through company-wide cost reduction initiatives and Operation Improvement (O/I) activities, which have been in place since last year.The copper foil business aims to achieve more than double the sales volume compared to the previous year, driven by the full-scale revenue generation from major customers in Greater China and the gradual increase in utilization rates of existing customers. With the rise in production capacity at the Malaysian plant, a recovery in quarterly profitability is also anticipated.Absolics, the investee for the glass substrate business, is on track to achieve concrete results by completing certifications with multiple global big-tech customers within the year. ISC is anticipated to continue its robust growth through the expansion of sales of AI test sockets to global clients. An official at SKC stated, "Despite a slower-than-expected market recovery last year, we will lay the groundwork for a recovery in performance by strengthening the fundamentals of existing businesses and through the commercialization of the glass substrate business, alongside achievements in other new ventures." [End]

2025-02-12

SKC Emphasized “Overcoming the Recession and Strengthening the Profit Structure” in the Annual General Meeting of Shareholders.

● SKC’s Annual General Meeting of Shareholders was held on March 26 at its headquarters in Jongno-gu, Seoul, with live online streaming for the second consecutive year to enhance shareholder accessibility.● New appointments include inside director Jihan Yu and non-executive director Changho Shin, and outside director Siwon Park was reappointed.● CEO Woncheol Park: “To focus on strengthening the profit structure and stabilizing new businesses in the early phase.”SKC (CEO Woncheol Park) held its 51st Annual General Meeting of Shareholders (AGM) on the morning of March 26 on Floor 6 of its headquarters at Jongno-gu, Seoul. Following last year, SKC live-streamed the AGM online once again to improve shareholder accessibility. As the chair of the AGM, SKC CEO Woncheol Park reported business performance results to shareholders, stating, “Last year, we experienced an unprecedented business environment in which front markets for our major businesses, such as EV batteries, semiconductors, and chemicals, subsided simultaneously.” He further explained, “Despite uncertainty in the business environment, we upgraded our business portfolios by achieving flexibility for front-end processes in non-core businesses of chemicals and semiconductors and investing in high value-added semiconductor back-end processing.”SKC has also consistently reinforced its ESG management. In July last year, it received an ‘A’ rating from Morgan Stanley Capital International (MSCI), one grade higher than the previous year. Its rating assessed by the Korea Institute of Corporate Governance and Sustainability (KCGS) was also upgraded to ‘A+’ in October of the same year.“We will strengthen the profit structure of our main businesses, such as copper foil for EV batteries and semiconductor test sockets, and promote early stabilization of new businesses, including semiconductor glass substrates and biodegradable materials,” explained CEO Woncheol Park regarding this year’s business strategies and emphasized, “We will strive for enhanced mid- to long-term sustainability through exhaustive risk management.” After the business report, explanations were provided for questions submitted by shareholders online in advance.At the AGM, Jihan Yu, SKC’s Chief Financial Officer (CFO) and Head of the Business Supporting Division, was newly appointed as an inside director, and Changho Shin, SK Inc.’s Head of the Portfolio Management Division, as a non-executive director. In addition, Siwon Park, a professor at Kangwon National University School of Law, was reappointed as an outside director.With these appointments, SKC aims to enhance the Board’s expertise in finance and investment while further strengthening its supervision functions over the management. The reappointment of director Siwon Park also allowed the ratio of female directors among outside directors to remain at 50%. Other bills to approve the financial statements and directors’ remuneration ceilings were passed.An SKC executive said, “Although the business environment remains uncertain this year, we will overcome it and secure the company’s profitability,” and added, “We promise to make our utmost effort to ensure that the company’s growth leads to increased shareholder value.” [End]

2024-03-26

SKC Emphasized “Overcoming the Recession and Strengthening the Profit Structure” in the Annual General Meeting of Shareholders.

● SKC’s Annual General Meeting of Shareholders was held on March 26 at its headquarters in Jongno-gu, Seoul, with live online streaming for the second consecutive year to enhance shareholder accessibility.● New appointments include inside director Jihan Yu and non-executive director Changho Shin, and outside director Siwon Park was reappointed.● CEO Woncheol Park: “To focus on strengthening the profit structure and stabilizing new businesses in the early phase.”SKC (CEO Woncheol Park) held its 51st Annual General Meeting of Shareholders (AGM) on the morning of March 26 on Floor 6 of its headquarters at Jongno-gu, Seoul. Following last year, SKC live-streamed the AGM online once again to improve shareholder accessibility. As the chair of the AGM, SKC CEO Woncheol Park reported business performance results to shareholders, stating, “Last year, we experienced an unprecedented business environment in which front markets for our major businesses, such as EV batteries, semiconductors, and chemicals, subsided simultaneously.” He further explained, “Despite uncertainty in the business environment, we upgraded our business portfolios by achieving flexibility for front-end processes in non-core businesses of chemicals and semiconductors and investing in high value-added semiconductor back-end processing.”SKC has also consistently reinforced its ESG management. In July last year, it received an ‘A’ rating from Morgan Stanley Capital International (MSCI), one grade higher than the previous year. Its rating assessed by the Korea Institute of Corporate Governance and Sustainability (KCGS) was also upgraded to ‘A+’ in October of the same year.“We will strengthen the profit structure of our main businesses, such as copper foil for EV batteries and semiconductor test sockets, and promote early stabilization of new businesses, including semiconductor glass substrates and biodegradable materials,” explained CEO Woncheol Park regarding this year’s business strategies and emphasized, “We will strive for enhanced mid- to long-term sustainability through exhaustive risk management.” After the business report, explanations were provided for questions submitted by shareholders online in advance.At the AGM, Jihan Yu, SKC’s Chief Financial Officer (CFO) and Head of the Business Supporting Division, was newly appointed as an inside director, and Changho Shin, SK Inc.’s Head of the Portfolio Management Division, as a non-executive director. In addition, Siwon Park, a professor at Kangwon National University School of Law, was reappointed as an outside director.With these appointments, SKC aims to enhance the Board’s expertise in finance and investment while further strengthening its supervision functions over the management. The reappointment of director Siwon Park also allowed the ratio of female directors among outside directors to remain at 50%. Other bills to approve the financial statements and directors’ remuneration ceilings were passed.An SKC executive said, “Although the business environment remains uncertain this year, we will overcome it and secure the company’s profitability,” and added, “We promise to make our utmost effort to ensure that the company’s growth leads to increased shareholder value.” [End]

2024-03-26

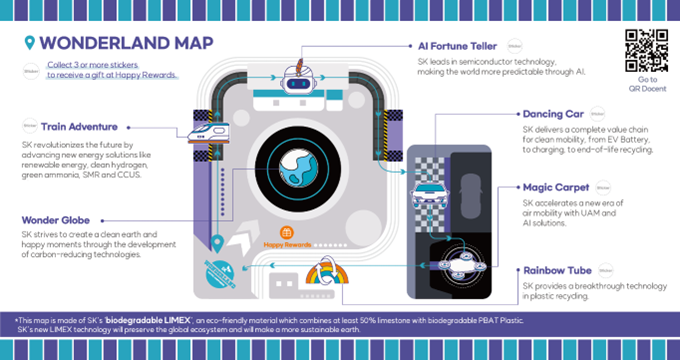

SKC Showcases Eco-friendly Materials Technology at the Theme Park Exhibition Space ‘SK Wonderland.’

● SKC introduces its flagship products of EV batteries, semiconductors, and eco-friendly materials in the exhibition space jointly operated by SK Group’s seven affiliates.● Participating in CES for five consecutive years since 2019, SKC continues introducing its innovative business model direction to the global market.SKC (CEO & President Woncheol Park) will showcase its materials technologies covering EV batteries, semiconductors, and eco-friendly sectors at CES (Consumer Electronics Show) 2024, the world’s largest industrial exhibition, held in Las Vegas, USA from January 9 to 12 next month (local time). At CES 2024, SKC will introduce its flagship products and technologies throughout SK Wonderland, an exhibition space jointly operated by SK Group’s seven affiliates. SK Wonderland is designed in a theme park format, allowing visitors to experience happiness in the ‘Net Zero’ world, where the climate crisis has been resolved.SKC’s products and technologies can be explored when visitors enter the exhibition. The guide map distributed when entering SK Wonderland is not made from regular paper. It is made of SKC’s biodegradable LIMEX, an eco-friendly new material combining the biodegradable plastic material PBAT with limestone-based LIMEX, which is harmless to nature. SKC has been working to commercialize biodegradable LIMEX materials since establishing a joint venture called SK TBMGEOSTONE in 2021, jointly with TBM, a Japanese company that owns LIMEX technology.In the Dancing Car zone, SK Group’s eco-friendly EV technologies are introduced as automobiles hanging from robot arms move like dancers in front of the screen. This is where copper foil, a key material for EV batteries, and silicon anodes that can significantly reduce EV charging time are presented. SKC has initiated the global expansion of its copper foil business with the first shipment from SK Nexilis’ new production facility in Kota Kinabalu, Malaysia, in October this year. It will further commence pilot production of high-quality silicon anodes early next year.In addition, visitors can obtain information on semiconductor glass substrates for high-performance computing in the AI Fortune Teller zone. Glass substrates, which improve the performance of semiconductor packages, are again featured at CES 2024 as a solution to speed up AI servers processing large-scale data.SKC has participated in CES for five consecutive years since 2019 (CES 2021 was not held), introducing new technologies and its direction of business model innovations to the global market. While the company focused on its film business in 2019, the first year of participation, the exhibition content has evolved in line with the direction of business model innovations, such as copper foil, glass substrates, and biodegradable materials.An SKC executive said, “We plan to showcase ESG materials solutions in EV materials, semiconductors, and eco-friendly sectors through SK Wonderland, which will become a landmark of CES 2024,” and added, “SKC will continue to develop technologies to enhance added values and discover new businesses.” [End][CES 2024 SK Wonderland Guide Map made with SKC’s biodegradable LIMEX]

2023-12-27

SKC Showcases Eco-friendly Materials Technology at the Theme Park Exhibition Space ‘SK Wonderland.’

● SKC introduces its flagship products of EV batteries, semiconductors, and eco-friendly materials in the exhibition space jointly operated by SK Group’s seven affiliates.● Participating in CES for five consecutive years since 2019, SKC continues introducing its innovative business model direction to the global market.SKC (CEO & President Woncheol Park) will showcase its materials technologies covering EV batteries, semiconductors, and eco-friendly sectors at CES (Consumer Electronics Show) 2024, the world’s largest industrial exhibition, held in Las Vegas, USA from January 9 to 12 next month (local time). At CES 2024, SKC will introduce its flagship products and technologies throughout SK Wonderland, an exhibition space jointly operated by SK Group’s seven affiliates. SK Wonderland is designed in a theme park format, allowing visitors to experience happiness in the ‘Net Zero’ world, where the climate crisis has been resolved.SKC’s products and technologies can be explored when visitors enter the exhibition. The guide map distributed when entering SK Wonderland is not made from regular paper. It is made of SKC’s biodegradable LIMEX, an eco-friendly new material combining the biodegradable plastic material PBAT with limestone-based LIMEX, which is harmless to nature. SKC has been working to commercialize biodegradable LIMEX materials since establishing a joint venture called SK TBMGEOSTONE in 2021, jointly with TBM, a Japanese company that owns LIMEX technology.In the Dancing Car zone, SK Group’s eco-friendly EV technologies are introduced as automobiles hanging from robot arms move like dancers in front of the screen. This is where copper foil, a key material for EV batteries, and silicon anodes that can significantly reduce EV charging time are presented. SKC has initiated the global expansion of its copper foil business with the first shipment from SK Nexilis’ new production facility in Kota Kinabalu, Malaysia, in October this year. It will further commence pilot production of high-quality silicon anodes early next year.In addition, visitors can obtain information on semiconductor glass substrates for high-performance computing in the AI Fortune Teller zone. Glass substrates, which improve the performance of semiconductor packages, are again featured at CES 2024 as a solution to speed up AI servers processing large-scale data.SKC has participated in CES for five consecutive years since 2019 (CES 2021 was not held), introducing new technologies and its direction of business model innovations to the global market. While the company focused on its film business in 2019, the first year of participation, the exhibition content has evolved in line with the direction of business model innovations, such as copper foil, glass substrates, and biodegradable materials.An SKC executive said, “We plan to showcase ESG materials solutions in EV materials, semiconductors, and eco-friendly sectors through SK Wonderland, which will become a landmark of CES 2024,” and added, “SKC will continue to develop technologies to enhance added values and discover new businesses.” [End][CES 2024 SK Wonderland Guide Map made with SKC’s biodegradable LIMEX]

2023-12-27

SKC unveils future technology blueprints for EV batteries, semiconductors, and eco-friendly materials

● SKC Tech Day 2023 was held on November 9 at SKC headquarters in Jongno-gu, Seoul.… Sharing technological roadmaps for core and new businesses● Showcasing super gap technologies, including future EV battery anode current collectors, rubber sockets for semiconductor testing, and biodegradable nonwovens● Highlighting competitive patent assets for each business… 230 copper foil patents, the largest patent network in the industry.SKC (CEO & President Woncheol Park) held SKC Tech Day 2023 on November 9 at its headquarters in Jongno-gu, Seoul, and unveiled technology blueprints for core and new businesses. SKC Tech Day is an event where SKC shares its research and development status and technology roadmaps with the market.SKC introduced various new technologies at SKC Tech Day 2023, including silicon anode materials, semiconductor glass substrates, and eco-friendly biodegradable materials together with copper foil for EV batteries, which has become SKC’s core business. Additionally, SKC’s recently acquired ISC debuted its semiconductor test solution technology at Tech Day.Regarding the EV battery materials business, where SKC has the top global competitiveness in technology, the company shared the achievements in developing copper foil for the 4680 cylindrical battery and R&D directions for anode collectors to be used in future EV batteries, such as all-solid-state batteries. Jung-kyu Ahn, Chief of SK nexilis Materials Technology Development Center, explained, “We are developing customer solutions having properties required by future EV battery anode current collectors, such as high strength, high elongation, high heat resistance, and corrosion inhibition.”The current status of patent assets related to copper foil was also shared at Tech Day. As of March of this year, SK nexilis had the most extensive patent network in the industry, with 230 applications. Cooper foil requires advanced manufacturing technology in that it significantly influences the productivity of EV battery manufacturers, not to mention the performance of EV batteries. SK nexilis produces top-quality copper foil based on technology accumulated through continuous research and development.Next came the introduction of silicon anode materials' technological competitiveness, which is considered a critical future element to feed on in the EV battery materials field along with copper foil. This year, SKC established a subsidiary, Ultimus, and plans to start pilot production in January next year by utilizing technology of UK-based tech company Nexeon, of which SKC became the largest shareholder through equity investment in January last year.In the semiconductor materials/components sector, glass substrates for high-performance computing and ISC’s semiconductor test solution technology were showcased. Absolics Inc., an invested subsidiary of SKC in the copper foil business, will complete the world’s first mass production facility at the end of this year. SKC also shared the company’s preparation for smart factory-based mass production, patent application status, and where the company is headed for next-generation product development, including AI Learning Accelerator with the expanded application of element embedding technology.ISC, which newly became a subsidiary of SKC this year, highlighted its excellent competitiveness in the market for rubber sockets, a key component for semiconductor testing. ISC succeeded in mass-producing rubber sockets for the first time in the world in 2003. It is considered to have secured a technological gap of more than ten years compared to latecomer competitors. Like SK nexilis, ISC has built the largest patent network in the industry, with 578 patents related to test sockets. ISC’s clients include over 300 global companies, including memory/non-memory semiconductor makers, fabless semiconductor companies, and big techs with large-scale servers.SKC also shared information on the eco-friendly biodegradable materials business, the company’s third growth engine, along with EV battery materials and semiconductor materials/components, introducing technological competence and commercialization efforts in progress for high-strength PBAT and biodegradable LIMEX materials. It was particularly underlined that 100% PBAT non-woven fabric, the first of its kind in the world developed by SKC, can potentially expand the market into hygiene products, wet wipes, and more, for which biodegradable materials have not previously been used. An SKC executive stated, “Based on the original technology secured through decades of continuous research and development, we are growing into a company with a technological moat that no other player can easily overcome,” and added, “We will actively also continue to communicate SKC’s technology roadmaps for the future market.” [End]

2023-11-09

SKC cranks up on new growth engines

● Q3 earnings release published on the 31st··· KRW 550.6B in sales & 44.7B in operating loss● Decided to sell off SK Pucore·fine ceramics business and cranked up on its business model (BM) innovation, acquiring ISC and investing in Chipletz● Securing investment funding resources of 900 billion won in the second half in combination with over 1 trillion won in cash to prepare for new growth shored up by financial stability ● Rated A+ by the KCGS··· enhancing ESG business practices in the midst of a business overhaulSKC (CEO: Woncheol Park) announced Q3 sales of 550.6 billion won and operating loss of 44.7 billion won on the 31st. In spite of declining revenue due to the worsening business landscape both at home and abroad, SKC is cranking up on business model innovation and a new growth platform, selling off non-core businesses, acquiring ISC, launching silicon anode on a commercial scale, and building a semiconductor glass substrate plant.Witnessed by management leaders like CEO Lim Eui-jun of SK PIC Global, CEO Lee Jae-hong of SK Nexilis, CEO Choi Du-hwan of SK Pucore who also serves as CFO of SKC, CEO Kim Jong-woo of SK Enpulse, Director Shin Jeong-hwan of the Business Development Division at SKC, and CEO Oh Joon-rok of Absolics, SKC announced its Q3 earnings release as described above at its head office in Jongro-gu. Closing the sale of its film business known to be the mother of all SKC businesses last year, SKC is putting business innovation in higher gear this year. In the second half alone, SKC finalized the sales of SK Pucore producing raw materials for polyurethane, its fine ceramics business and chip washing operations one after another, securing investment funding resources close to 1 trillion won.At the same time, SKC is taking a series of steps in preparation for new growth. SKC’s EV battery material business added new mid to long-term copper foil supply contracts in the fourth quarter and commissioned a highly cost-competitive copper foil plant in Malaysia in a bid to significantly boost profitability. In addition, the completion of a pilot silicon anode line will wrap up preparation for further expansion of its EV battery material business.SKC’s semiconductor business has gone through the most drastic change this year. After selling its fine ceramics, chip washing and wet chemical operations one after another, SKC took onboard ISC, a chip test solution provider, as a new mainstay subsidiary. SKC will also complete a semiconductor glass substrate plant by yearend. SKC also made a strategic investment in Chipletz, a US chip packaging solution provider, this September to enhance global competence of its semiconductor downstream operations. SKC will also win more customers for high-value pre-process products such as CMP pad and blank mask to name a few.SKC has also established Haiphong City, Vietnam as the global production base of its eco-friendly biodegradable materials, accelerating their commercialization drive. Furthermore, SKC has invested in Halio, a smart glass manufacturer, to expand its reach to energy-saving solutions.SKC also continues to foster ESG management practices. SKC was rated A+, the highest level ever given to companies covered in the annual ESG assessment conducted by the Korea Institute of Corporate Governance and Sustainability (KCGS). Rated A for two consecutive years from 2021 to 2022, SKC has been persistent in fostering ESG management, even in the midst of continuous business overhaul focused on EV battery, semiconductor and eco-friendly materials. SKC was also uprated by the MSCI from BBB of last year to A this August.“We are restructuring our businesses rapidly to fund stable growth going forward,” CFO Choi Du-hwan of SKC said. “Drawing upon stable growth, we will diversify our revenue models and pave way for high growth by stockpiling proprietary technology.”l SKC Earnings by Quarter (In: 1 won)

l SKC Preliminary Earnings in Q3 by Business

Unit (In: 1 won)

2023-10-31

SKC sells polyurethane ingredient business for 410.3B won

● Selling 100% stake in SK Pucore to Glenwood Private Equity, an alternative investment firm, on the 12th● Securing resources to fund additional investments ···accelerating a business model innovation drive with focus on EV battery/chips/eco-friendly materialsSKC (CEO & President Woncheol Park) is selling its polyurethane (PU) ingredient business. This decision will allow SKC to further accelerate its business model innovation drive focused on EV battery, chips, and eco-friendly materials.SKC decided in a board of directors (BoD) meeting on the 12th to sell 100% stake in SK PUCore to Glenwood Private Equity (Glenwood PE) for 410.3 billion won. The business up for sale also includes the polyurethane ingredient business for optical applications that SKC acquired from Woori Finechem in 2019. Going through necessary procedures, SKC intends to close the deal by no later than the end of the year.SK PUCore, SKC’s key PU ingredient production subsidiary, has produced polyol, an ingredient for polyurethane, for over 30 years since 1991. SK PUCore has been rapidly expanding its overseas production bases in the United States, China, Poland and Mexico, as one of the two pillars of SKC’s chemical business along with SK PIC Global. The company is also entrenching its presence as a global leader of the PU industry, launching eco-friendly PU ingredient business with the first re-polyol and bio-polyol ever developed in Korea.SKC decided to sell off the PU ingredient business in a bid to complete its vision as a global material ESG solution company focused on EV batteries, semiconductors and eco-friendly materials. The PU ingredient business needed significant additional investments to cope with a rising market demand and cater for the ever diverse customer needs. Considering its business model innovation vision, SKC decided to make the sale to a company better equipped to fund the growth and development of the industry.Glenwood PE acquiring SKC’s PU ingredient business is one of the top-tier private equity fund management companies in Korea, known to be making aggressive investments after acquisitions to develop growth drivers and strengthen corporate competitiveness. Glenwood PE is expected to bolster the global competitiveness of the PU ingredient business, maintaining employment stability and making additional investments after taking over SK PUCore.With the sales proceed, SKC aims to enhance its financial stability and cover investment needs to meet global demand for eco-friendly materials, boost its competitive edge and expand its business presence. SKC is innovating its business model rapidly, dedicating a copper foil plant in Malaysia, investing in biodegradable material production in Vietnam, and acquiring equity in the chip packaging solution provider Chipletz this year.“We will realign our business portfolio with EV batteries, semiconductors and eco-friendly materials in a bid to lay the groundwork for global expansion and future growth,” said an official at SKC. “We will rapidly complete our business model innovation to grow into a global ESG material solution company representing Korea.” [End]

2023-10-12

SKC CEO Woncheol Park purchases 1,244 SKC shares ··· enhancing management accountability

● SKC CEO & President Woncheol Park bought SKC shares worth about KRW 100 million··· in a sign of commitment to and confidence in future growth● CFO Doohwan Choi also purchased 500 shares··· management leaders upholding more accountability subsequent to the purchase of treasury stock by the CompanySKC CEO & President Woncheol Park announced an in-market purchase of 1,244 SKC shares on Sep. 18. The average purchase price per share was about KRW 80,000, and the total amount of the treasury stock purchase was about KRW 100 million.Since inaugurated as the CEO of SKC last March, Woncheol Park has been intent on portfolio shift in favor of high-value materials built on proprietary technologies, putting spurs to innovations for sustainable growth. With growing uncertainties in externalities to business activities such as global economic slowdown, interest rate hike and oil price rise, etc., CEO Woncheol Park decided to buy SK shares to demonstrate his commitment to accountable management practices and confidence in SKC’s future growth as the CEO.CFO Doohwan Choi also followed the suit in a sign of commitment to enhancing management accountability and increasing shareholders’ value. CFO Doohwan Choi bought 500 SKC shares in the market.“SKC management leaders’ purchase of SKC shares in addition to the Company’s purchase of treasury shares at around KRW 200 billion last year suggest the Company’s determination to boost corporate valuation and shareholders’ value as well as management accountability,” an official at SKC said. “SKC will work harder to strengthen its competitiveness in primary business lines to deliver greater performance and foster sustainable growth.” [End]

2023-09-18

SKC joins hands with Hai Phong City, Vietnam to expand its global presence

● Agreeing to ‘eco-friendly, high-tech materials partnership on the 12th··· in the presence of SKC CEO Wonchel Park and Secretary Le Tien Chau of Hai Phong City’s Party Committee● Hai Phong City to extend a variety of infrastructure support at SKC’s investment decision··· “SKC winning a Southeast Asian ally in its global presence expansion”SKC (CEO & President Woncheol Park) joins hands with Hai Phong City, one of Vietnam’s key industrial cities, to beef up its global presence in Southeast Asia.SKC and Hai Phong City signed a partnership agreement on eco-friendly high-tech materials in SKC head office in Jongro-gu, Seoul on the 12th. The signing ceremony was attended by leaders of both parties to the agreement, including CEO Woncheol Park and Head of Business Development Division Jeonghwan Shin at SKC and Secretary Le Tien Chau of Hai Phong City’s Party Committee who also serves as the country’s lawmaker and Le Trung Kien, Head of Hai Phong Economic Zone Authority (HEZA).Signing the agreement as a part of its endeavor to expand globally in cutting-edge industrial sectors encompassing EV battery, semiconductor, and eco-friendly materials, SKC will consider phasing in investments into eco-friendly and high-tech materials business in Hai Phong City. In response, Hai Phong City has agreed to extend full-blown support in terms of electrical power and environmental infrastructure at SKC’s investment decision and help SKC to win incentives available from Vietnam’s central government.Among five municipalities of Vietnam along with the capital city of Hanoi and Ho Chi Minh City in the south, Hai Phong is Vietnam’s No.1 port city and one of the most important industrial hubs. The city has attracted over 10 billion dollars up to now in investments from multiple Korean companies. Hai Phong City aspires to turn itself into a more sustainable industrial city by accommodating more high-tech and eco-friendly material businesses. Breaking ground for a large-scale copper foil production plant with annual throughput of approximately 50,000 tons in Kota Kinabalu, Malaysia in 2021 through its EV battery copper foil-producing subsidiary SK nexilis, SKC ventured into Southeast Asia in full swing. The copper foil plant in Malaysia will be completed sometime in the 2nd half of this year and swung into full-fledged commercial production. Against the backdrop, the partnership agreement with Hai Phong City will enable SKC to secure an investment platform in Vietnam and bolster up investment in Southeast Asia, which is one of the pillars of SKC’s global expansion.“Thanks to its attractive infrastructure, Vietnam is being highlighted as a base for global companies,” said an official at SKC. “Hai Phong is the most easily accessible area in Vietnam, offering significant advantages as an investment destination for global expansion going forward.”[Key attendees including CEO Woncheol Park of SKC (the 3rd from the right) and Le Tien Chau, Secretary of Hai Phong City’s Party Committee and a member of the National Assembly of Vietnam (the 3rd from the left) are posing for a commemorative photo.]

2023-06-12

SKC joins hands with Hai Phong City, Vietnam to expand its global presence

● Agreeing to ‘eco-friendly, high-tech materials partnership on the 12th··· in the presence of SKC CEO Wonchel Park and Secretary Le Tien Chau of Hai Phong City’s Party Committee● Hai Phong City to extend a variety of infrastructure support at SKC’s investment decision··· “SKC winning a Southeast Asian ally in its global presence expansion”SKC (CEO & President Woncheol Park) joins hands with Hai Phong City, one of Vietnam’s key industrial cities, to beef up its global presence in Southeast Asia.SKC and Hai Phong City signed a partnership agreement on eco-friendly high-tech materials in SKC head office in Jongro-gu, Seoul on the 12th. The signing ceremony was attended by leaders of both parties to the agreement, including CEO Woncheol Park and Head of Business Development Division Jeonghwan Shin at SKC and Secretary Le Tien Chau of Hai Phong City’s Party Committee who also serves as the country’s lawmaker and Le Trung Kien, Head of Hai Phong Economic Zone Authority (HEZA).Signing the agreement as a part of its endeavor to expand globally in cutting-edge industrial sectors encompassing EV battery, semiconductor, and eco-friendly materials, SKC will consider phasing in investments into eco-friendly and high-tech materials business in Hai Phong City. In response, Hai Phong City has agreed to extend full-blown support in terms of electrical power and environmental infrastructure at SKC’s investment decision and help SKC to win incentives available from Vietnam’s central government.Among five municipalities of Vietnam along with the capital city of Hanoi and Ho Chi Minh City in the south, Hai Phong is Vietnam’s No.1 port city and one of the most important industrial hubs. The city has attracted over 10 billion dollars up to now in investments from multiple Korean companies. Hai Phong City aspires to turn itself into a more sustainable industrial city by accommodating more high-tech and eco-friendly material businesses. Breaking ground for a large-scale copper foil production plant with annual throughput of approximately 50,000 tons in Kota Kinabalu, Malaysia in 2021 through its EV battery copper foil-producing subsidiary SK nexilis, SKC ventured into Southeast Asia in full swing. The copper foil plant in Malaysia will be completed sometime in the 2nd half of this year and swung into full-fledged commercial production. Against the backdrop, the partnership agreement with Hai Phong City will enable SKC to secure an investment platform in Vietnam and bolster up investment in Southeast Asia, which is one of the pillars of SKC’s global expansion.“Thanks to its attractive infrastructure, Vietnam is being highlighted as a base for global companies,” said an official at SKC. “Hai Phong is the most easily accessible area in Vietnam, offering significant advantages as an investment destination for global expansion going forward.”[Key attendees including CEO Woncheol Park of SKC (the 3rd from the right) and Le Tien Chau, Secretary of Hai Phong City’s Party Committee and a member of the National Assembly of Vietnam (the 3rd from the left) are posing for a commemorative photo.]

2023-06-12

SKC Reports First-Quarter 2023 Financial Results

● A turnaround in the EV battery materials and chemicals business expected in Q2 ··· continued investment in future growth drivers including chip glass substrate● Enhancing ESG management practices by considering adoption of an internal carbon pricing system and strengthening expertise and diversity in BoD membershipSKC (CEO & President Woncheol Park) announced on May 4 that the company posted 669.1 billion won in revenue and 21.7 billion won in operating loss in the 1st quarter of this year. Despite dwindling profits on the account of the worsening business landscape both at home and abroad, SKC vows to press ahead with investments in future growth drivers and ensure a rebound in the 2nd quarter in the wake of investment initiatives in its flagship businesses.Witnessed by management executives including CEO Lim Eui-joon of SK picglobal, CEO Lee Jae-hong of SK nexilis, Choi Doo-hwan, CEO of SK pucore and CFO of SKC, CEO Kim Jong-woo of SK enpulse, Choi Kap-ryong, Head of SKC’s ESG Management Division, and Shin Jeong-hwan, Head of SKC’s Business Development Division, SKC announced the Q1 2023 financial results in its head office in Jongro-gu, Seoul. The business data announcement was also streamed on YouTube.In terms of financial results breakdown by business line, the EV battery material business headed by copper foil manufacturer SK nexilis raked in 180.4 billion won in revenue and 300 million won in operating profit. In the face of sluggish market demand, the sales figure climbed up when compared with the previous quarter, with both sales volume and revenue expected to increase concurrently thanks to market demand expected to rebound from the 2nd quarter primarily in North America and Europe. SK nexilis is building a full-scale growth drive platform by expanding its global production capacity in Malaysia and Poland. In particular, the company will be able to secure excellent cost competitiveness when its Malaysian plant kicks off commercial operation in the 2nd annual half.The chemicals business spearheaded by SK picglobal and SK pucore posted 393.3 billion won in revenue and 6 billion won in operating loss. Although their mainstay products including propylene oxide (PO) and propylene glycol (PG) continued to suffer a market price decline, the companies drastically curtailed losses in comparison with the previous quarter. They are incrementally improving sales and profitability by expanding sales from the 2nd quarter in major markets including North America and Asia. The semiconductor materials business centered around SK enpulse recorded 87.5 billion won in revenue and 7.9 billion won in operating income. The sales figure declined in arithmetic terms from the previous year as sales revenue standards for PCB business changed, but profitability improved. On top of that, as the CMP pad and blank mask businesses took on a full-blown growth trajectory despite a global slump in the chipmaking industry, operating profit jumped 60% when compared with the same period of last year. As requests for evaluation of high-value products arrive one after another, SK enpulse plans to accelerate its drive to expand its customer base this year.Turning crisis into opportunity, SKC is working hard on future growth drivers including semiconductor glass substrate and silicone anode materials. The company is building a glass substrate production plan which is now over 30% complete and scheduled to go live on a commercial scale in the 2nd half of next year. The silicon anode material business will see investments in pilot production sometime in the 2nd quarter prior to full-scale commercial production. SKC is also planning to break the ground for an eco-friendly biodegradable material production plant this year, with commercial production slated for 2025.The company also continues to step up its ESG drive. By establishing its ESG-based investment process this February, SKC is laying ground for full-fledged adoption of the internal carbon pricing system in the 2nd half of this year by preparing in-house training programs. In March, the company had its anti-corruption management system certified with ISO 37001 to enhance transparency into management practices. Furthermore, more female outside directors were appointed to the Board of Directors (BoD) to raise the share of female outside directors to 50%. The BoD performance management system was overhauled to further enhance expertise and diversity in the BoD membership.“Closing the sale of the film business which marked the origin of the company last year, SKC is building a platform for full-fledged growth as a ‘global ESG material solution provider’,” said an official at SKC. “We will push ahead with strong innovation drive against the worsening business landscape to rapidly turn around our business performance and step onto a growth trajectory.” [End]

2023-05-04